How to Use Life Insurance for Estate Tax Planning

March 13, 2025

A life’s work can vanish too easily. You spend years building something—security, comfort, a legacy—only to realize that, without a plan, much of it may slip through your fingers. Estate taxes wait like an inevitability, taking their share before your loved ones ever see what you intended for them.

Life insurance is a way to push back against that loss, to make sure what you built stays with the people who matter. But how does it really work? And is it the right choice for you?

Let’s strip away the complexity and get to the heart of it…

(1) What Are Estate Taxes and Why Do They Matter?

When you pass away, your estate may owe taxes before your heirs receive anything. The federal estate tax applies if your assets exceed a certain threshold, which is adjusted annually. If your estate surpasses this limit, a significant portion could go to the government instead of your loved ones.

Additionally, some states impose their own estate or inheritance taxes, further reducing the amount your heirs receive. These taxes can create financial strain, especially if your assets are tied up in real estate or a business. This can make it difficult for your heirs to cover the costs without selling valuable property. For the latest estate tax thresholds and regulations, visit the IRS Estate Tax

(2) How Life Insurance Can Help Cover Estate Taxes

Life insurance provides an immediate source of cash to your heirs, bypassing probate. This ensures they have funds to cover estate taxes, legal fees, and other expenses. Without a life insurance policy, your beneficiaries may be forced to sell assets, take out loans, or use personal savings to settle estate-related costs. The right policy can prevent this financial burden and preserve your family’s wealth.

It also allows your heirs to maintain ownership of key assets such as homes, businesses, or investments. A properly structured life insurance plan ensures your legacy remains intact. It also provides peace of mind that your family won’t face unnecessary financial hardship.

(3) Choosing the Right Life Insurance for Estate Planning

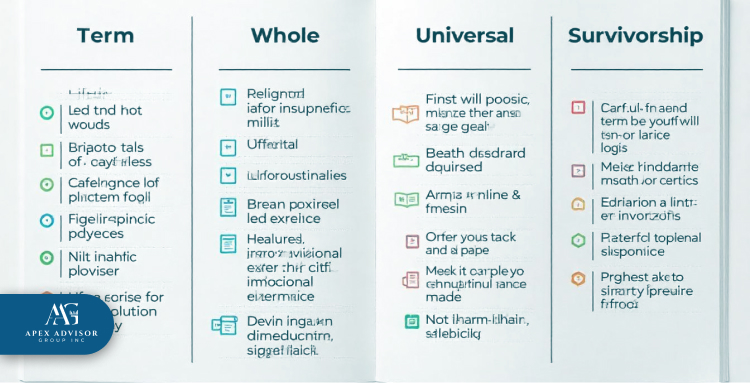

Selecting the right life insurance policy depends on your estate planning goals and financial situation. Here’s a breakdown of options to consider:

Term Life vs. Permanent Life: What’s the Difference?

Term life insurance offers coverage for a set period, typically 10 to 30 years. It’s more affordable than permanent life insurance but expires if you outlive the term. It can be useful for temporary needs. However, it’s not ideal for estate tax planning because estate taxes are due upon death, no matter when that happens.

Permanent life insurance, on the other hand, provides lifelong coverage and accumulates cash value over time. This ensures that a death benefit is available when needed to cover estate taxes and other obligations.

Whole Life Insurance: A Reliable Option for Estate Planning

Whole life insurance offers lifetime coverage and builds cash value that grows over time. Premiums remain consistent, and the policyholder can borrow against the accumulated cash value if needed. This makes it a stable and predictable option for estate planning, ensuring a guaranteed payout to heirs.

Universal Life Insurance: Flexible and Tax-Friendly

Universal life insurance offers more flexibility than whole life insurance. Policyholders can adjust premium payments and death benefits, making it a good choice for those with fluctuating financial circumstances. Additionally, the tax-deferred growth of the policy’s cash value can provide extra financial benefits.

Survivorship Life Insurance: A Smart Choice for Married Couples

Also known as second-to-die insurance, survivorship life insurance covers two people, typically spouses, and pays out after both have passed. Since estate taxes are usually due after the second spouse dies, this policy ensures funds are available when needed. It is often more affordable than individual permanent policies and is particularly beneficial for high-net-worth couples looking to reduce estate tax burdens.

(4) Why an Irrevocable Life Insurance Trust (ILIT) Can Save You Thousands

One of the most effective ways to keep life insurance proceeds tax-free is by using an Irrevocable Life Insurance Trust (ILIT). If your life insurance policy is owned by your estate, the payout may be subject to estate taxes. An ILIT prevents this by holding the policy outside your estate, ensuring that the death benefit remains tax-free for your heirs.

By transferring ownership of the policy to the ILIT, you remove it from your taxable estate while maintaining control over how the funds are distributed. However, to maximize its benefits, the ILIT must be set up correctly. Once the policy is placed in the trust, you cannot take it back or make changes. Proper structuring with the help of an estate planning attorney ensures compliance with tax laws and maximizes the advantages of an ILIT.

(5) Smart Ways to Pay Life Insurance Premiums Without Tax Issues

To avoid unnecessary taxes, consider these strategies for paying life insurance premiums:

Annual Gifting

You can gift money to the trust each year, up to the annual tax-free gift limit, to cover premium payments. This keeps funds out of your taxable estate while ensuring premiums are paid on time.

Joint Gifting Strategies

Married couples can take advantage of gift-splitting, effectively doubling the amount they can gift tax-free each year.

Structuring Payments Properly

Payments should be structured correctly to avoid triggering gift tax consequences or including the policy in your estate. Consulting with a financial professional ensures compliance with tax regulations.

(6) Mistakes People Make with Life Insurance and Estate Planning

Even with careful planning, common mistakes can lead to unnecessary taxes and complications. Avoid these pitfalls:

Naming the Wrong Owner or Beneficiary

If the policy is owned by the estate or the beneficiary designation is incorrect, the proceeds could be subject to estate taxes.

Forgetting to Update Policies

Life insurance policies should be reviewed regularly to reflect changes in estate value, family structure, and financial needs. Failing to adjust coverage could leave heirs with a shortfall.

Ignoring State Estate Taxes

Even if you don’t owe federal estate taxes, state-level estate or inheritance taxes could still apply. Understanding state tax laws helps prevent unexpected financial burdens.

Looking for more information? Read these related posts.

Secure Your Estate with Life Insurance Strategies from Apex Advisor Group

When planning your estate, life insurance can play a vital role in minimizing estate taxes and ensuring a smooth transfer of assets to your beneficiaries. Here’s how we can assist you in utilizing life insurance for effective estate tax planning:

Customized Life Insurance Strategies

We specialize in crafting life insurance solutions tailored to your estate planning needs. We help you determine the right type and amount of coverage to address estate taxes.

Minimize Estate Tax Liability

We provide guidance to ensure that your life insurance policy is structured to reduce your estate's tax burden. This helps provide financial relief to your heirs.

Estate Liquidity Solutions

Life insurance can provide immediate liquidity to your estate. This is essential to cover estate taxes and other expenses without having to sell off valuable assets. We help you choose the right policy to ensure your estate remains intact.

Trust Planning for Tax Efficiency

We can guide you through using an Irrevocable Life Insurance Trust (ILIT). This allows the death benefits to bypass estate taxes and pass directly to your beneficiaries.

Policy Review and Adjustments

We regularly review your life insurance policy to ensure it continues to meet your evolving estate planning goals. We make adjustments as needed to maintain tax efficiency.