Blogs

By Apex Advisor Group Inc

December 13, 2025

Top Tax Considerations for Business Succession

Passing a business down feels like handing over a story you wrote with sweat, late nights, and countless decisions. But stories don’t end simply because the author steps away. They twist, they turn, and sometimes they face battles no one saw coming.

Taxes, for example. They’re more than numbers on a page; they’re silent players that can change everything when you least expect it.

And in the world of business succession, understanding those tax shadows is smart and necessary. But what exactly should you watch out for? That’s where the real story begins.

1) Estate Taxes Can Still Apply to Small Business Owners

Plenty of small businesses are asset-rich, even if their cash flow is modest. Commercial property, equipment, trademarks, and client contracts can quietly add up. Once you factor in your business valuation plus your personal home, retirement accounts, and life insurance, it’s not hard to cross the line.

“2025 Federal Estate Tax Exemption:

$13.61 million per individual

~$27.22 million for married couples”

(Source: IRS, Unified Credit under §2010(c))

This looks generous for now, but there’s a deadline ticking. Unless Congress steps in, the exemption gets cut roughly in half after 2025, dropping to around $6 million per person. That puts a lot more small business owners in the taxable range than most people assume.

And here’s the catch: Florida doesn’t have its own estate tax, but that doesn’t make you immune. The federal estate tax rate can reach 40% once you exceed the exemption.

So no, being “small” doesn’t guarantee safety. If your business owns property, holds patents, or carries real value in goodwill, your heirs could be facing a surprise tax bill, one that could force them to sell assets just to pay it.

2) Why You Need a Professional Valuation for Your Business

Many owners lean on informal estimates when valuing their business—especially during succession planning—but that guesswork can lead to major tax issues. When it’s time to transfer ownership or pass the business through an estate, the IRS expects proper documentation backed by a qualified, credentialed appraisal. Without it, both the owner and successor risk unexpected tax assessments.

IRS Requirement:

Qualified appraisals are required for business transfers during estate or gift planning.

“Undervaluation can result in penalties up to 40% of the tax understatement.”

(Source: IRS Code §6662, Valuation Misstatements)

An inaccurate valuation doesn’t just throw off the math; it can open the door to penalties, audits, and legal complications. If your business has real assets, growth potential, or a unique market position, its true value needs to be on paper and defensible. A professional valuation keeps the plan clean, protects your successors, and prevents disputes before they start.

3) Should You Transfer Shares Now or Later?

Thinking about handing over your business before you're gone? Moving shares during your lifetime offers tax-smart advantages, yet each choice brings its own tradeoffs.

Giving equity now helps shrink your taxable estate. That means less exposure to federal estate taxes when the time comes. Plus, your heirs can start benefiting from earnings or appreciation right away.

“2025 IRS Annual Gift-Tax Exclusion:

$18,000 per recipient per year”

(Source: IRS Annual Gift Tax Exclusion, 2025)

Going over the limit means you have to report gift tax but most people can use their lifetime exemption to avoid paying. Still, the paperwork and rules make it a hassle.

Transferring shares post-death means heirs may enjoy a step-up in basis to current market value. If they sell later, this reduces capital gains taxes. That rollover can be a major financial win, especially in fast-growing businesses.

Choosing when to transfer requires balancing present-day estate shrinkage and possible gift-tax consequences against the future benefit of a stepped-up basis. Each path has its own tax implications, so tailor the strategy to your long‑term goals and your heirs’ situation.

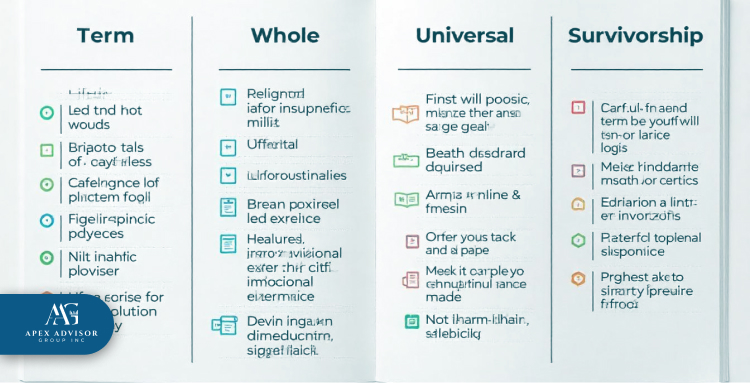

4) How FLPs and Trusts Help With Business Succession

Family Limited Partnerships (FLPs) and Grantor Retained Annuity Trusts (GRATs) are popular tools for transferring business ownership gradually while keeping control in the hands of the original owner. FLPs, in particular, may allow valuation discounts on non-controlling interests due to limited marketability or lack of voting rights.

But these benefits only hold up if everything is properly documented and has a clear business purpose. If the structure looks sloppy or purely tax-driven, the IRS may step in and challenge the advantages.

The IRS pays close attention to FLPs that appear to lack legitimate business purposes. A flawed structure or failure to follow partnership formalities can lead to full revaluation and penalties.

5) Don’t Overlook Life Insurance in Your Business Exit Plan

Life insurance is a go-to method for funding buy-sell agreements, allowing a smooth transfer of ownership when a business partner exits or passes away. Ownership of the policy determines how the payout is taxed. Policies owned by the business are treated differently from those held by individual owners.

Cross-purchase agreements involve each owner holding policies on the others. Entity-purchase agreements place ownership with the business itself. Both have different consequences for taxation, reporting, and deductibility.

“Life insurance tax treatment depends on the ownership structure, and proceeds may be taxable if not planned properly.”

(Source: Tax Policy Center, Life Insurance and Estate Tax Planning, 2023)

Proceeds from policies held by the business may be included in the taxable estate or treated as income in some cases. Agreements should be reviewed alongside policy ownership to avoid surprises.

6) Your Business Structure Affects Your Succession Taxes

Sole proprietorships, partnerships, S-Corporations, and C-Corporations all come with different rules for taxes, ownership, and succession planning. For instance, if you transfer S-Corp shares to the wrong kind of trust—like a non-grantor trust—it can automatically terminate the company’s S-Corp status, triggering unintended tax consequences.

C-Corporations, on the other hand, may face double taxation: first, when the business sells its assets, and again when the profits are distributed to shareholders as dividends.

Without a clear succession plan that accounts for entity structure, heirs may face unnecessary taxes or disputes over ownership.

Each structure triggers different obligations, from capital gains to corporate income taxes. A review of bylaws or operating agreements is necessary to identify risks and close loopholes.

7) State Taxes May Still Affect Your Business Succession

Florida doesn’t have estate or inheritance taxes, but if the business owns property or operates in states like New York or Massachusetts that do, it could still face tax liabilities there. Multi-state businesses are often subject to additional estate, inheritance, or income taxes outside Florida.

State-level rules vary and are not always based on the owner's primary residence.

“13 states currently impose estate or inheritance taxes, and businesses with multi-state presence may be affected.”

(Source: Tax Foundation, 2024 State Estate and Inheritance Tax Chart)

Some states trigger nexus rules with minimal activity. If you lease property, keep inventory, or hire remote workers in another state, that state may claim taxing rights. Even when your headquarters sits in Florida, you still need to account for tax exposure elsewhere.

8) What If You’re Not Passing the Business to Family?

Passing the business to a child isn’t the only path forward. Some owners opt to sell to employees through Employee Stock Ownership Plans (ESOPs). Others transfer ownership to charitable organizations through donor-advised funds or charitable remainder trusts.

Each alternative has its own reporting rules, valuation requirements, and tax impacts. When structured correctly, they can support retirement goals while securing the future of the company.

“ESOPs are subject to fiduciary rules, annual valuations, and reporting obligations under federal law.”

(Source: U.S. Department of Labor, ESOP Statistics & Compliance Guide, 2023)

Properly managed ESOPs can provide liquidity for owners while creating a sense of ownership among employees. They also require careful compliance with ERISA standards and IRS reporting.

Still working through the tax details? You might find clarity in our other posts.

Planning to Step Away From Your Business? Apex Advisor Group Helps You Avoid Tax Trouble During Succession

Exiting a business requires more than a handshake and a valuation. Timing, documentation, and tax elections all influence how much stays in your pocket and how much goes to the IRS. Decisions around ownership transfers, insurance funding, or trust planning can carry lasting tax effects.

Apex Advisor Group works with business owners to identify risk areas early and structure clean, tax-efficient exits.

Contact Apex Advisor Group to make your transition smooth, strategic, and tax-ready.

December 7, 2025

The Impact of Financial Coaching on Your Tax Returns

Tax season in Florida looks simple. No state income tax suggests smooth sailing, yet federal forms with hidden deductions and obscure credits turn it into a maze, and most people treat it like a checklist only to miss opportunities and trigger avoidable mistakes.

Financial coaching changes the game by teaching year-round strategies that turn taxes from a chore into a tool, showing which deductions actually apply, how small planning moves can boost refunds, and how to stay audit-ready before April arrives.

Here is a twist most Floridians never notice. What if your tax return could do more than just give money back? Apex Advisor Group shows how a simple shift in approach can completely reshape your financial future

1) How Financial Coaching Differs From Traditional Tax Preparation

Many people assume tax preparation is only about filling out forms. This approach solves the immediate task while missing opportunities to improve financial habits. Financial coaching takes a wider perspective. It does not simply prepare your return; it helps you manage money smarter throughout the year.

Unlike traditional preparation, coaching focuses on anticipating challenges and turning taxes into a strategic advantage. Apex Advisor Group explains the complex IRS code in plain language so clients understand which moves matter most for their situation.

Major ways financial coaching changes the experience include

Proactive Planning: Clients make small adjustments throughout the year that optimize deductions and credits.

Behavioral Shifts: Coaching encourages better spending, tracking, and record-keeping habits that benefit both current and future returns.

Clarity and Confidence: Breaking down IRS jargon helps clients feel informed and in control instead of overwhelmed.

These improvements strengthen results immediately and set up Floridians for the particular challenges of their state’s tax rules, from retirees managing Social Security to small business owners dealing with federal requirements.

2) What Makes Florida’s Tax Situation Unique

Florida’s no-state-income-tax reputation can be misleading. While the state does not tax income, federal rules still apply, and overlooked details can affect your bottom line.

Retirees and Social Security: Social Security benefits are not taxed by Florida, yet federally, up to 85% of benefits may be taxable depending on income. According to the Social Security Administration, about 55% of beneficiaries pay federal taxes on benefits (SSA). Strategic planning can minimize this impact.

Entrepreneurs and LLCs: Single-member LLCs are treated as disregarded entities for federal tax purposes, meaning the business income flows directly to the owner’s personal return. Recent federal tax changes can alter deductions and credits, making careful planning essential.

Overlooked Credits and Deductions: Federal deductions and credits, such as the Child Tax Credit or energy-efficient home credits, can dramatically change refunds. Missing these can mean thousands left on the table.

Understanding these local quirks is the first step to making smarter tax choices. Financial coaching builds the bridge between awareness and action, preparing Floridians for careful strategies that can lead to better outcomes, which is the focus of the next section.

3) Why Coaching Creates Better Outcomes Than Just Compliance

Traditional tax preparers often focus on filing returns after the fact, addressing immediate needs without fostering long-term financial understanding. In contrast, financial coaching emphasizes building sustainable habits and knowledge that extend beyond tax season.

Enhanced Financial Literacy: A report from the Consumer Financial Protection Bureau found that clients who participated in financial coaching improved their budgeting and saving habits, which led to measurable gains in financial well-being over time. Yes, you read that right, the guidance goes beyond numbers and teaches you how to think about money differently (CFPB).

Increased Tax Refunds: purposeful financial planning can lead to higher tax refunds. In Florida, the average federal tax refund for the 2025 tax year was approximately $3,900, the highest in the nation. This increase is partly due to strategic tax planning and maximizing eligible credits and deductions (Axios).

Long-Term Financial Benefits: Financial coaching focuses on behavior modification and empowerment, leading to improved financial stability. Clients who participated in coaching programs reported better financial decision-making and increased confidence in managing their finances.

These examples show why coaching produces better outcomes than simple compliance. In the next section, we’ll explore how Apex Advisor Group applies these principles to develop tailored tax strategies for Floridians across various industries.

4) How Apex Advisor Group Builds Tax Strategies for Floridians

Apex Advisor Group does more than just crunch numbers. Their model is rooted in financial coaching that pairs tax planning with literacy, so clients not only get compliant returns but also understand why those returns look the way they do.

The approach is designed for Florida’s unique economic environment, where industries like tourism, real estate, and healthcare fuel growth and bring their own tax complexities.

Blending Tech With Human Insight

Apex integrates digital tools with one-on-one coaching, giving clients real-time access to numbers that matter. This helps reduce errors and provides instant clarity. According to the IRS, math mistakes remain one of the most common errors in filed returns, with over 2.4 million corrections issued in 2024. That is a staggering reminder of how much smarter filing can be with the right systems in place (IRS).

Florida-Centric Industry Knowledge

Tax planning in Florida is not a mass produced exercise. Apex customizes strategies to sectors that dominate the state. For example, a small business owner in Orlando’s tourism sector faces very different challenges than in Tampa. Understanding these complexities ensures deductions and credits are maximized without falling into compliance traps.

Education That Sticks

Coaching is built around showing clients how their decisions ripple into tax season. That could mean learning how to structure an LLC for better federal treatment or understanding how retirement withdrawals impact taxable income. The goal is lasting financial literacy, not just a quick fix.

Apex’s tax strategies are not isolated to short-term wins. They’re designed to create resilience for Floridians whose financial landscapes shift with every policy change or market disruption.

5) How Smarter Refunds Can Shape Your Financial Future

A refund is more than a check from the IRS, it is a chance to reshape your financial direction. Apex Advisor Group encourages clients to treat refunds as stepping stones toward bigger goals rather than quick spending cash.

Boosting Retirement Savings: Adding refunds to retirement contributions can grow into meaningful security over time, turning a short-term gain into a long-term safety net.

Cutting Down Debt: Applying refunds to high-interest debt lightens the monthly burden and frees up cash for future goals, creating immediate relief and lasting impact.

Funding New Projects: Refunds can serve as starter capital for business ventures, home improvements, or personal development, giving Floridians a springboard for growth without relying on borrowed money.

Smarter refund choices build a habit of forward-looking financial behavior.

6) Why 2025 Is the Right Time to Start Financial Coaching

The financial landscape is shifting fast, and 2025 is not the year to leave taxes on autopilot. From policy updates to new ways of earning income, the tax environment now demands preparation that goes beyond the basics.

More Scrutiny Ahead: The IRS is focusing on closer checks, especially for small businesses and self-employed workers, which makes thoughtful planning a must.

Inflation Pressures: Every dollar carries less weight when costs rise, making it more important to ensure refunds and deductions are used wisely.

The Rise of Flexible Work: More Floridians are earning through side hustles and contract work, which brings a tangle of forms and reporting challenges. Coaching provides the clarity needed to manage it without stress.

In 2025, financial coaching is less about luxury and more about survival.

What Happens When Apex Advisor Group Coaches You Through Tax Season

Working with Apex Advisor Group feels different from the typical tax grind. Instead of handing over a pile of paperwork and waiting for results, clients step into a guided process that makes tax season less of a burden and more of a strategy session. Coaching here means having a team that explains, simplifies, and helps you make choices that feel smart and intentional.

Clarity Instead of Confusion: Complex forms and shifting rules get translated into plain language, making the path forward easier to understand.

Year-Round Awareness: Tax season is not treated as an isolated event, it becomes part of a larger financial rhythm that supports stability and growth.

Confidence in Decisions: Clients walk away knowing not only what happened on their return, they also understand why, which strengthens their future decisions.

Apex Advisor Group is positioned as the Florida partner for turning tax season into a moment of strength rather than stress. If you are ready to rethink how taxes fit into your financial life, now is the time to contact Apex Advisor Group before April pressure takes over.

November 15, 2025

Top Financial Reporting Tips for Small Businesses

If you believe that running a business is solely about generating sales, it’s time to broaden your perspective. Accurate financial reporting is more than just a nice bonus; it’s the foundation for making smart decisions and staying compliant with the law. When you have a clear understanding of your finances, you’re in a stronger position to make the right choices, secure funding, and steer your business in the right direction.

We’ll help you take charge of your numbers, cut through the confusing accounting terms, and give you practical tips to set up and maintain solid financial reporting practices.

Why a Small Business Needs Financial Reporting

Financial reporting is key to a small business’s success. It gives you a clear picture of your financial health and helps build trust with important people like owners, investors, and lenders. With accurate reports, you’re more likely to secure partnerships, loans, and investments. Without them, your business might come across as disorganized or unreliable.

Reports also keep you on track with tax and legal rules, helping you avoid fines and audits. By keeping track of your income, expenses, and profits, you’ll stay in line with IRS requirements and file taxes on time.

Financial reports also help with long-term planning and growth. They help you set goals, spot risks, and adjust your strategy when needed. And in tough times, they help you stay resilient by showing you where to cut back or improve efficiency to keep things running smoothly.

8 Essential Financial Reporting Tips for Small Business

Let's explore 8 crucial financial reporting tips that can significantly enhance your small business's financial health and ensure regulatory compliance.

1. Start a Monthly Reporting Process

Monthly reporting is a proactive approach that helps small businesses stay on top of their finances. Unlike quarterly reporting, which may delay the identification of financial issues, monthly reports provide a real-time snapshot of cash flow, revenue, and expenses.

To implement a monthly routine, establish a schedule to review your financial statements, including the balance sheet, income statement, and cash flow statement. Ensure that all transactions are recorded promptly, and reconcile accounts at the end of each month. A consistent process reduces errors and prepares your business for tax season or potential audits.

2. Hire a Professional Bookkeeper

A professional bookkeeper ensures that your financial records are accurate, organized, and compliant with regulations. They can handle tasks like recording transactions, managing payroll, and categorizing expenses, freeing up your time to focus on business growth.

When hiring a bookkeeper, look for qualifications like certifications, experience with your industry, and proficiency in accounting software. Verify their references and ensure they have a strong understanding of tax laws and reporting standards.

3. Use the Right Accounting Tools and Automate Financial Processes

Investing in reliable accounting software simplifies financial reporting and reduces human error. Look for features like automated invoicing, expense tracking, and integration with your bank accounts. Tools like QuickBooks, Xero, and FreshBooks are excellent for small businesses.

Automation further enhances efficiency. For instance, automating payroll, expense categorization, and recurring invoices saves time and ensures consistency. Cloud-based solutions allow you to access financial data anytime, offering real-time insights for decision-making.

More for you: Top Accounting Software for Tax Preparation

4. Track Key Financial Metrics

Tracking essential financial metrics is crucial for understanding your business's performance and identifying areas for improvement. Here are three key metrics every small business should monitor:

Gross Profit Margin: (Revenue - Cost of Goods Sold) / Revenue. This measures the profitability of your core business operations, showing how efficiently you produce or deliver your goods and services.

Net Profit Margin: Net Income / Revenue. This evaluates overall profitability after all expenses, including taxes and interest, are deducted. A higher net profit margin indicates better financial health and cost management.

Current Ratio: Current Assets / Current Liabilities. This metric assesses your business's ability to meet short-term obligations, ensuring you have sufficient liquidity to handle unexpected expenses or cash flow challenges.

Setting up a financial dashboard in your accounting software can help you track these metrics in real-time. Regularly reviewing them ensures you remain proactive in addressing potential issues and optimizing your financial strategy.

5. Categorize Expenses Accurately

Proper expense categorization ensures accurate financial statements and simplifies tax preparation. Misclassified expenses can lead to inaccurate financial reports or missed tax deductions.

Develop a clear system for categorizing expenses, and review it periodically to ensure consistency. Categories may include payroll, office supplies, marketing, and utilities. Many accounting tools offer automated categorization, which can save time and reduce errors.

6. Review Financial Statements Regularly

Regularly analyzing your financial statements helps identify potential red flags early. For example, a declining cash flow may indicate overspending, while a high accounts receivable turnover may suggest payment collection issues.

Analyze your Balance Sheet for changes in assets, liabilities, and equity. Review your Income Statement for revenue trends and profitability and examine your Cash Flow Statement to understand cash flow patterns.

Look for red flags such as declining profit margins, increasing debt levels, and negative cash flow from operations. The Statement of Retained Earnings (part of the Statement of Changes in Equity for Corporations) should also be reviewed to understand how profits are being utilized.

7. Get Granular with Reporting

Detailed reporting allows you to understand your finances on a deeper level. Break down data by department, project, or product line to identify what drives profitability or incurs costs.

Let’s say, tracking revenue by service type or analyzing marketing expenses by campaign can provide actionable insights. Granular reporting enables better resource allocation and strategic planning.

8. Plan for Taxes

Tax planning is an integral part of financial management. Set aside funds regularly to cover your tax obligations and avoid last-minute financial strain.

Stay updated on changes in tax regulations to take advantage of deductions and credits applicable to small businesses. Consider working with a tax advisor who can help optimize your tax strategy and ensure compliance with IRS requirements.

Also read: How Tax Resolution Services Can Help with IRS Issues

Advanced Financial Reporting Strategies

Monitoring Key Performance Indicators (KPIs):

Key Performance Indicators (KPIs) are essential tools for evaluating the financial and operational performance of your business. Identifying the right KPIs for your business depends on your industry and goals, but common financial KPIs include:

Revenue Growth Rate: Tracks the percentage increase in revenue over a specific period, indicating business expansion.

Accounts Receivable Turnover: Measures how efficiently you collect payments from customers, highlighting cash flow management.

Operating Expense Ratio: Compares operating expenses to total revenue, helping you identify cost-saving opportunities.

Regularly monitoring these KPIs allows you to pinpoint inefficiencies, improve profitability, and stay aligned with your strategic objectives. Advanced accounting tools or dashboards can automate KPI tracking for real-time updates.

Implementing Financial Forecasting and Budgeting:

Financial forecasting and budgeting are critical for long-term planning. Forecasting involves projecting future financial performance based on historical data and current market trends. This helps you anticipate challenges, seize growth opportunities, and make informed decisions. Key steps include:

Gathering Historical Data: Use past financial reports to establish trends in revenue, expenses, and cash flow.

Setting Realistic Assumptions: Consider market conditions, economic trends, and industry benchmarks to make accurate predictions.

Creating Detailed Budgets: Allocate funds to different departments, projects, or initiatives, ensuring spending aligns with business priorities.

Using Financial Ratios for In-Depth Analysis:

Financial ratios provide a deeper understanding of your business’s financial health by assessing profitability, liquidity, and solvency. Commonly used ratios include:

Return on Assets (ROA): Net Income / Total Assets. This measures how efficiently your business uses assets to generate profit.

Debt-to-Equity Ratio: Total Liabilities / Total Equity. This evaluates your financial leverage and indicates your ability to meet long-term obligations.

Quick Ratio: (Current Assets - Inventory) / Current Liabilities. This assesses your ability to meet short-term obligations without relying on inventory sales.

Benchmark these ratios against industry standards to identify areas for improvement and ensure your business remains competitive. Use these insights to optimize operations, manage debt effectively, and enhance financial performance.

Get Professional Financial Guidance From Apex Advisor

Establishing robust financial reporting practices is a strategic imperative for small business success. From implementing monthly reporting and engaging professional bookkeeping services to leveraging accounting software, monitoring KPIs, and conducting in-depth financial analysis, each of these strategies plays a crucial role in providing a clear and accurate picture of your business's finances. However, navigating the complexities of financial reporting can be challenging.

The Apex Advisor team understands the unique financial challenges small businesses face and offers tailored solutions to help you achieve your financial goals. Our team of experienced professionals can assist you with:

Setting up efficient financial reporting systems

Analyzing your financial statements and KPIs

Developing accurate financial forecasts and budgets

Optimizing your tax strategy

Providing ongoing financial advice and support

Let usr take the stress out of financial management so you can focus on growing your business. Contact us today for a consultation and discover how we can empower your financial decisions and set your business up for lasting success.

November 8, 2025

Tax Preparation Tips for Real Estate Investors

Tax preparation for real estate investors defines every decision I make within Apex Advisor Group. I have seen how thoughtful planning turns properties from passive assets into powerful income sources. Doesn’t real estate carry vast potential, yet demand precision and awareness in its complex tax landscape?

Each transaction holds numbers that reveal a deeper story, from depreciation schedules to deductible expenses. Many investors focus on property value, overlooking how strategic tax preparation safeguards their profits.

My goal is to help investors master that balance, turning complexity into clarity. The process begins long before filing season, where small choices create lasting financial strength. And that is where everything starts to take shape.

1) Keep Your Records Like a Pro Because Memory Is Not a Tax Strategy

Numbers guide every tax decision, yet their accuracy depends on how they are recorded. I often tell clients that poor record-keeping can quietly erode profits.When every receipt, invoice, and expense is accurately documented and organized, it becomes easier to track financial activity, evaluate performance, and see the bigger picture of an investment portfolio. This helps investors identify what works, what drains capital, and where tax savings live.

I encourage a structured system that reduces errors and builds long-term consistency.

Digital record systems: Modern accounting software automatically tracks rental income, categorizes expenses, and generates detailed summaries for each property. This saves time during tax season and eliminates the confusion of manual data entry.

Cloud storage: Secure, remote backups prevent document loss and make it easy to share records with accountants. When every statement is accessible in one place, audits and reviews become less stressful.

Expense tagging: Labeling each cost by property or project simplifies tax filing later. This approach ensures that every deduction is attributed correctly, leaving no opportunity missed.

Research published by the National Association of Realtors shows that nearly 56% of real estate investors miss deductions due to poor record-keeping or incomplete expense tracking (NAR, Real Estate Investment Report 2024).

Good record-keeping is about awareness. Once investors can see their numbers in motion, the next step, maximizing deductions, comes naturally.

2) Discover the Hidden Gold Inside Deductible Expenses

Every dollar spent managing a property has potential value. The difference lies in identifying which expenses are deductible and how to claim them efficiently. Many investors underestimate how much they can save through accurate expense reporting. My role often involves showing clients how to transform ordinary spending into structured tax advantages.

Here are some of the most beneficial areas to focus on:

Mortgage interest and property taxes: These are two of the largest deductions available to property owners. Properly separating interest from principal payments allows accurate deduction calculations that reduce taxable income.

Repairs, maintenance, and management fees: Everyday property upkeep often gets overlooked, even though it directly supports income generation. From repainting to plumbing repairs, these costs are legitimate deductions that should never go unrecorded.

Insurance and utilities: Insurance premiums and utility bills tied to rental operations are deductible as operating expenses. They demonstrate ongoing costs essential to maintaining an investment.

Marketing and travel expenses: Advertising rental listings or traveling to inspect properties also count. Investors often forget mileage, gas, or accommodation costs linked to property visits, which can make a noticeable difference during filing.

When tracked accurately, these deductions transform property ownership into a strategic business activity rather than simple asset management. Once you secure these savings, depreciation enhances that advantage even further.

3) Make Depreciation Work Like a Secret Investment Partner

Depreciation might sound technical, yet it represents one of the strongest tax tools for property investors. It allows you to write off the value of a property gradually, reflecting the wear and tear that occurs over time. Even as the market value grows, the IRS still allows depreciation deductions each year.

I help investors calculate precise depreciation schedules based on property type. Residential rental properties typically depreciate over 27.5 years, while commercial assets depreciate over 39 years. Accurate schedules ensure compliance while maximizing returns.

Investors can enhance benefits through specific strategies, such as:

Cost segregation studies: Identify components of a property like flooring, lighting, or HVAC systems that can depreciate faster than the building itself, accelerating deductions.

Land versus building separation: Only the building and certain improvements are depreciable. Correct separation ensures proper deduction calculations.

Periodic review: Depreciation schedules must be updated when renovations or additions occur, capturing additional tax benefits and avoiding errors.

Findings from MGO CPA indicate that cost segregation studies can accelerate depreciation by identifying specific property components like flooring, lighting, and appliances, boosting short-term cash flow (MGO CPA, Cost Segregation for Investors)

Depreciation quietly rewards patience, steadily working behind the scenes to strengthen and grow a portfolio over time.With this foundation, investors can start planning the next move, preserving capital through strategic exchanges.

4) Keep Your Capital Growing with Smart 1031 Exchanges

Growth in real estate often comes through reinvestment. A 1031 exchange allows investors to defer capital gains taxes by selling a property and acquiring another of similar kind. It is about delaying them strategically so that money keeps working instead of being frozen in tax obligations.

Executing a 1031 exchange correctly requires careful planning and attention to deadlines. Key considerations include:

Identify replacement property within 45 days: This strict IRS rule ensures eligibility for tax deferral. Missing the window eliminates the benefit.

Close within 180 days: The new property must be purchased within 180 days from the sale of the old property to maintain the exchange status.

Use a qualified intermediary: A third-party professional holds the sale proceeds to prevent immediate taxation and guarantees compliance.

Document every step: Proper contracts, settlement statements, and proof of timelines are important to avoid audit issues.

Guidance from TurboTax also emphasizes using a qualified intermediary to hold proceeds during the exchange, ensuring the investor avoids receiving cash or "boot" that could trigger tax liabilities (TurboTax, 1031 Exchange Compliance).

When executed properly, a 1031 exchange preserves capital and allows investors to reinvest without interruption. With capital protected, focus can shift to organizing finances and preparing for long-term growth strategies.

5) Keep Business and Personal Finances in Separate Lanes Always

Keeping personal and business finances separate may sound simple, yet many investors unintentionally mix them, creating challenges in accounting, tax reporting, and financial management.This mistake creates confusion when tracking expenses and increases exposure during audits. Financial separation is not about formality, it is about protection and precision.

I recommend investors maintain dedicated systems for property ventures.

Business bank accounts: A separate account for property income and expenses ensures that every transaction is clear. It prevents mixing funds and simplifies tax reporting.

Individual credit cards for investments: Using one card for all property-related purchases creates a detailed transaction trail. This helps verify deductions without relying on fragmented records.

Entity formation: Structuring properties under entities like LLCs protects personal assets and presents a professional front when dealing with lenders or tenants. It also provides potential tax advantages depending on state laws.

A clear financial boundary builds credibility and control. With organized systems in place, investors can manage tax obligations confidently throughout the year instead of rushing at the last minute.

6) Manage Estimated Taxes Before They Manage You

Quarterly estimated taxes often surprise new investors. Unlike traditional employment where taxes are withheld automatically, real estate income requires manual forecasting and scheduled payments. Missing these can lead to penalties that cut into returns.

Preparation is the solution. I help clients design a steady rhythm of tax planning rather than treating it as an annual event.

Set aside income monthly: Allocating a fixed portion of rental earnings each month prevents sudden financial strain when quarterly deadlines approach.

Forecast using data: By analyzing rental income, expected expenses, and property improvements, reliable estimates minimize overpayment or underpayment.

Quarterly reviews: Regular financial reviews ensure adjustments are made when market conditions shift or new investments begin producing income.

Once investors get used to consistent forecasting, focus returns to growth and opportunity, not paperwork.

Work with Apex to Create a Smarter Tax and Investment Strategy

Behind every successful real estate investor stands a network of professionals who understand the complexity of financial growth. My mission at Apex Advisor Group goes beyond compliance. I translate numbers into strategies, ensuring investors know how every financial choice affects their portfolio.

We help clients make decisions that sustain profitability rather than short-term wins. This includes guiding them through cost segregation studies, entity restructuring, or investment transitions that align with evolving goals. From accurate record-keeping to capital preservation, every piece connects to create a complete picture of financial stability.

Contact Apex Advisor Group to strengthen your tax strategy and make every property decision count. Our team ensures investments remain tax-efficient, compliant, and ready for whatever comes next.

October 14, 2025

Tax Planning Strategies for Real Estate Investors

You spend months searching for the right property, running numbers late at night, and making sacrifices so your investment can grow. However, when tax season arrives, the excitement turns into frustration. The rent checks look strong, the equity is building, yet the tax bill seems to swallow far more than you expected.

Many investors know that hollow feeling when cash flow looks good on paper yet feels thin in reality. The truth is, the issue is rarely the property itself, it is the missing tax strategy behind it. Real estate can be a powerful wealth builder, however only if you learn to bend the tax code in your favor. The question is, where do you start?

1) Facing the Tax Challenges Every Investor Struggles With

You know that sinking feeling when your rental income seems solid, yet your bank balance does not reflect it. Real-estate returns often take a hit before you even see them. That is usually not because of vacant units or interest costs, it is because the tax code often reads like a wall, however it can become your strongest ally when you learn its language and timing.

The Hidden Tax Black Hole

Most real-estate investors admit they miss deductions, whether due to confusion over depreciation, subpar bookkeeping, or simple oversight. This translates into tens of thousands in lost relief every year.When “Paper Profits” Vanish

Many investors fail to capture startup costs, closing expenses, or travel and technology expenditures as deductions, even though they are perfectly legitimate. Recognizing these gaps in your return is the first move toward recovery.Passive-Loss Pitfalls

Rental losses may sit suspended under passive-activity rules, inescapable unless you qualify as a real-estate professional or properly document your participation. Many investors miss this nuance entirely, leaving valuable offsets unused.

The good news is that once you spot where value leaks, you begin to reclaim control. In the next section, you will see how the right entity structure and professional-status planning can transform those tax strains into strategic wins.

2) Choosing the Right Structure

Tax planning begins with setting up not only a solid entity however a strategic anchor for the deals you pursue, the responsibilities you bear, and the outcomes you aim to achieve.

Choosing whether to hold real-estate investments via an LLC, partnership or S-corporation is not merely a legal matter however a long-term decision that shapes control, flexibility and tax efficiency across multiple deals.

Which Entity Structure Will Still Serve You Five Deals From Now?

Over 70% of small investors will choose an LLC in 2025 to protect their properties and streamline taxes, reflecting the appeal of liability protection and pass-through tax treatment in a flexible setup.

Partnerships and S-corporations also offer advantages, for instance, both protect personal assets and avoid double taxation. A partnership often allows preferred profit allocations aligned with hands-on work, and an S-corporation may reduce employment tax on active income.

As you grow and scale, think of your entity as a compass that guides how you fund acquisitions, allocate distributions and adjust ownership—not just as paperwork on an IRS form.

Who Counts as a Real-Estate Professional and Why Status Matters

By qualifying as a real-estate professional under IRS rules, your rental-property losses are treated as active instead of passive. This allows them to offset other income instead of being trapped under passive-activity limitations.

To earn that status you must spend over 750 hours in real-property trades or businesses during the year and perform more than half of your total personal-service hours in real estate; meeting both thresholds is non-negotiable.

If achieved, you unlock far greater flexibility, no matter whether your investments are one or many, especially if you elect to group multiple rental properties as one activity to simplify qualification.

This structural planning is not abstract. Once you know where your entity stands and whether you qualify as an active investor, you can deploy tactics that turn depreciation and energy credits from overlooked details into deliberate strategies. In the next section we will explore how depreciation becomes your most reliable ally when it is paired with cost segregation and bonus expensing.

3) Turning Depreciation Into an Advantage

Turning depreciation from a taxing necessity into fuel for growth begins the moment you acquire a property. It is not an expense however a strategic tool you deploy on day one when you track basis accurately and plan for recapture thoughtfully.

Depreciation, Not a Loss, However a Tool You Can Spend

Real estate depreciation is not a bureaucratic line item however a flexible credit against income, allowing you to reinvest what you would otherwise pay in taxes.

Thoughtful investors know that depreciation deductions often compound value IRS rules permit catching up missed depreciation in the year of a study, opening the door to significant near-term tax relief for properties added since 1987.

Cost Segregation, or How to Fast-Track Tax Savings Without Hassle

A focused cost segregation study reallocates parts of a building such as electrical systems, carpeting, landscaping into shorter depreciable classes (5, 7, or 15 years) instead of the standard 27.5 or 39 years.

Current bonus depreciation rules allow expensing on qualified property placed in service after September 27, 2017, if construction begins with significant physical work or passes the safe harbor 10% test outlined by the IRS. These provisions can front-load deductions, accelerating cash flow and strengthening reinvestment capacity.

These strategies are not just theoretical. They transform depreciation into a deliberate, cash-positive lever you control. In the next section, you will see how these savings layer with deferral techniques and strategic exits to elevate your returns even further.

4) Planning for Growth and Exit

Every seasoned real estate investor knows growth depends not only on acquisition however on timing and exit strategy. Strategic moves like 1031 exchanges, opportunity Zone investments, and cash-out refinances can postpone tax, preserve equity, and offer flexibility when markets shift.

The Anatomy of a 1031 Exchange That Actually Closes

To defer capital gains with a 1031 exchange, two deadlines govern your success. You have 45 days from the sale of your property to identify potential replacements, and 180 days to complete the purchase. Deadlines cannot be extended except in presidentially declared disasters.

Variations such as reverse or improvement exchanges offer flexibility when you need to buy before selling or handle construction. They still require strict adherence to both the 45-day and 180-day rules, otherwise the deferral fails.

Opportunity Zones, Revisited, Is the Tax Break Still Worth the Detour?

Opportunity Zones were designed to channel capital into underinvested communities, and they still deliver meaningful incentives for real estate investors.

When you roll eligible gains into a Qualified Opportunity Fund (QOF), those gains are deferred until the earliest of December 31, 2026, or the date you sell your QOF stake.

If the QOF investment is held for at least five years, 10% of the deferred gain is permanently excluded. If it is held for at least seven years, that exclusion increases to 15 percent.

Perhaps most powerful, if you keep the QOF investment for at least ten years, you receive a basic adjustment to fair market value, which means the appreciation itself is never taxed.

Capital continues to withdraw. Funding into OZ projects fell from $682 million in early 2023 to just $229 million in the same quarter of 2024, showing investor caution amid inflation and uncertainty about program longevity.

Borrowing Equity, Not Selling, Less Tax Today, Profit Tomorrow

A cash-out refinance can convert appreciating equity into liquid funds without triggering a taxable event, because the IRS views loan proceeds as debt rather than income.

In practice, this means you might refinance up to 75 to 80% of your property value, freeing capital while continuing to grow your investment portfolio.

You must remember, this approach only defers tax until an eventual sale of the property. Your taxable basis remains the same, so gains will surface later unless paired with another deferral strategy such as a 1031 exchange or Opportunity Zone reinvestment.

These strategies are each powerful on their own. They are even more effective when layered intelligently, combining tax deferral with reinvestment timing to make your exit not an end however a new beginning. In the next section you will see how these decisions compound when aligned with energy-credit stacking and credit optimization.

5) Extra Savings You Might Be Overlooking

In the intricate world of real estate investment, overlooked opportunities can significantly impact your bottom line. By strategically leveraging energy incentives and understanding state-specific tax nuances, you can uncover hidden savings that enhance your financial outcomes.

Energy Incentives and Credits Stacked the Right Way

The Inflation Reduction Act of 2022 introduced expanded tax benefits for energy-efficient improvements in real estate. Under Section 179D, building owners can claim deductions ranging from $0.58 to $5.81 per square foot for energy-efficient commercial buildings, with higher deductions available when prevailing wage and apprenticeship requirements are met.

Section 45L offers tax credits up to $5,000 per home for contractors constructing qualified new energy-efficient homes. To qualify, homes must meet specific energy efficiency standards, and contractors must obtain necessary certifications.

It's crucial to integrate energy modeling with construction planning to maximize these incentives. Failing to do so can result in missed opportunities and potential compliance issues.

State and Local Headaches You Didn’t Know You Had

State and local taxes (SALT) can significantly affect your investment returns. The Tax Cuts and Jobs Act of 2017 capped the federal deduction for SALT at $10,000, prompting many investors to reassess their state tax strategies.

Understanding city surcharges, multistate filing requirements, and withholding obligations is essential. For instance, some states impose additional taxes on rental income or have unique depreciation rules that can impact your tax liabilities.

6) Staying Organized All Year

For investors, the difference between smooth tax planning and last-minute stress often comes down to organization. Keeping track of dates and documents is not just a matter of discipline, it is a way to stay ahead of penalties, preserve deductions, and walk confidently into any audit.

The Investor’s Tax Calendar That Keeps You Ahead

Track quarterly estimated tax deadlines to avoid penalties.

Mark dates for issuing 1099s and filing property-related documents.

Sync state and federal deadlines to prevent missed filings.

Use digital reminders for smoother cash flow planning.

Simple Record-Keeping Habits That Protect You in an Audit

Store receipts, invoices, and contracts in cloud-based folders.

Use mileage and expense tracking apps for accuracy.

Keep logs proving material participation in investments.

Organize records monthly instead of rushing at year-end.

A Complete Tax Planning Partner for Investors

Every investor knows the tax code is complex, however strategy only matters when it works in real life. We design tax plans that fit your calendar, decisions, and long-term goals.

Our process begins with a clear map of immediate savings and future strategies, so you always know the next step. We coordinate directly with your attorneys, CPAs, and portfolio managers, removing guesswork and wasted time.

From day one, we also prepare your exit, structuring for 1031 exchanges, Opportunity Funds, or buyouts, ensuring smoother transitions that protect your hard-earned gains and keep surprises from costing you later.

We believe tax strategy should feel less like scrambling at deadlines and more like a long-term partnership where every decision counts toward your future. Contact us to schedule your consultation and see how proactive tax planning can change the way you grow and protect your wealth.

October 7, 2025

How to Maximize Tax Savings with Strategic Account Management

Every year, millions of Americans sit at the kitchen table in April, surrounded by receipts, statements, and a creeping sense that something is slipping through their fingers. They worked hard, saved diligently, and earned well, yet the numbers tell another story, too much of their money disappears into taxes. For many, the frustration is not only about what they owe, it is about what they could have kept if their accounts were managed with strategy and foresight.

Consider the retirement savings sitting untouched in one account, the brokerage balance quietly incurring capital gains in another, or the health savings account waiting to be used more effectively. These small, overlooked decisions often create a costly pattern. The real surprise comes when you discover how much strategic account management can change.

1) The New Era of Tax-Focused Investing

Over the past two years, investors have moved decisively toward accounts that do more than hold assets. Separately managed accounts, or SMAs, have become one of the fastest-growing choices for individuals who want investment management designed with taxes in mind.

By mid-2024, tax-managed SMAs had grown by more than 67% since the end of 2022, surpassing the growth of tax-managed mutual funds and signaling a major shift in investor priorities.

This rise is associated with both performance and control. Unlike pooled mutual funds, SMAs provide investors with direct ownership of securities, allowing for targeted tax strategies such as loss harvesting or gain deferral. The ability to tailor decisions at the account level reflects a broader demand for personalization in financial planning.

Technology has accelerated this shift, turning strategies like loss harvesting and direct indexing from tools once reserved for institutions and wealthy families into options now accessible to everyday investors through automation.

Firms from Vanguard to Betterment are applying algorithms to scan portfolios for tax-saving opportunities in real time, offering benefits at account minimums far lower than in the past.

This convergence of personalized accounts and accessible technology marks a turning point. Taxes are no longer a secondary concern that comes at year-end. They are becoming a central part of how portfolios are built and maintained, which leads naturally to the next question: how can investors coordinate their accounts to ensure maximum efficiency?

2) Pillar One: Coordinating Every Account for Maximum Tax Efficiency

In the quietly revolutionary world of modern investing, the question is not whether you have the right assets, rather whether you have them in the right place. The discipline of asset location has quietly become one of the most powerful tools in long-term portfolio design.

It means placing tax-efficient instruments, such as municipal bonds or low-turnover equity strategies, in taxable accounts. At the same time, less efficient assets are sheltered in tax-advantaged accounts, where their impact is softened.

Industry research confirms that this strategic placement can boost annual after-tax returns by 0.14 to 0.41 percentage points, translating to $2,800 to $8,200 more per year for a $2 million portfolio in higher tax brackets.

By managing equity, bond, retirement, and brokerage accounts collectively, they enhance the effect of tax-smart techniques such as tax-loss harvesting and strategic rebalancing. Studies suggest this coordinated approach can add an extra 0.05% to 0.30% per year in after-tax return.

Here is a clearer look at what a coordinated strategy offers:

Asset Location with Precision

By placing income-heavy bond investments in sheltering accounts, and equity investments, especially index funds or tax-aware ETFs, in taxable ones, investors can reduce tax drag and unlock compounded gains over time.Holistic Oversight Across All Accounts

When advisors manage a client’s entire portfolio as a unified whole, they avoid piecemeal decisions and tap into synergies across accounts. This synchronized approach amplifies the benefits of tax-smart tools and refines decisions like when to harvest losses or rebalance.Quantifiable Difference Over Time

When every account is managed with both allocation and location in mind, the cumulative edge, not in performance alone, however in tax-frugality, can reshape outcomes meaningfully.

While these gains may seem modest at first, their compounding, combined with proper placement and oversight, can make a significant difference. Next, we explore tax-loss harvesting and direct indexing, showing how proactive management turns potential tax liabilities into optimized returns.

3) Pillar Two: Year-Round Tax-Loss Harvesting and Smart Indexing

Tax-smart investing is no longer a strategy reserved for the affluent; it has become a cornerstone of modern portfolio management. Leading financial institutions have embraced this approach, offering clients sophisticated tools to enhance after-tax returns.

Tax-Loss Harvesting Across Accounts

Systematic, year-round harvesting of losses transforms market fluctuations into tax-saving opportunities. By realizing losses throughout the year to offset gains, portfolios sustain higher after-tax performance. This proactive approach goes beyond the traditional year-end review, keeping tax efficiency in motion across all accounts.

Direct Indexing with Continuous Review

Direct indexing allows investors to own individual securities rather than pooled funds, creating far more opportunities to capture losses. Continuous monitoring makes it possible to fine-tune exposures, harvest losses on specific holdings, and customize portfolios to individual tax circumstances and personal values.

Industry Validation

Tax-sensitive management, including selective harvesting and careful rebalancing, has become a widely recognized method for enhancing returns in taxable accounts. Applied consistently, these techniques can deliver measurable after-tax advantages without changing a client’s risk profile or overall strategy.

Mainstream Adoption

What was once confined to high-net-worth investors is now available to a wider audience. Even automated platforms offer tax-aware strategies, bringing customized, loss-harvesting opportunities into everyday portfolios.

4) Pillar Three: Power of Tax-Advantaged Accounts

Tax-advantaged accounts Health Savings Accounts (HSAs), Roth IRAs, and 401(k)s offer unique benefits that can significantly enhance long-term financial growth. By strategically utilizing these accounts, investors can optimize their portfolios for tax efficiency.

Triple Tax Advantage with HSAs

Health Savings Accounts (HSAs) provide a rare combination of tax benefits:

Pre-tax contributions reduce taxable income in the year they are made.

Tax-free growth allows investments to appreciate without being taxed annually.

Tax-free withdrawals for qualified medical expenses make HSAs a powerful tool for healthcare savings.

Beyond medical expenses, HSAs can serve as a supplementary retirement account. Once individuals reach age 65, withdrawals for non-medical expenses are permitted without penalty, though they are subject to income tax.

Enhanced Growth with 401(k) Plans

Investing through a 401(k) plan can lead to substantial growth over time. A study by Charles Schwab demonstrated that investing via a 401(k) could result in a portfolio value approximately 23% higher over years compared to a taxable brokerage account, assuming an 8% annual return.

Tax-Free Growth with Roth IRAs

Roth IRAs allow contributions with after-tax dollars, providing tax-free growth and qualified withdrawals in retirement. This feature makes Roth IRAs particularly advantageous for those who anticipate being in a higher tax bracket during retirement.

Strategic Asset Placement

To maximize tax efficiency, it's essential to place assets in the appropriate accounts:

High-turnover or short-term assets should be held in tax-deferred accounts like 401(k)s to defer taxes on gains.

Long-term, low-turnover assets are best suited for taxable accounts, where long-term capital gains are taxed at a lower rate.

Let’s say you have $10,000 to invest. Growth stocks in a Roth IRA compound tax-free, bonds in a 401(k) defer taxes until withdrawal, and an HSA covers medical costs with tax-free dollars. This mix keeps taxes low while giving flexibility for retirement and healthcare.

5) Pillar Four: Proactive Planning That Anticipates Change

Proactive planning entails anticipating changes and seizing opportunities to improve tax outcomes. This approach includes structural decisions, the use of available credits, and ongoing adaptation to changing tax laws.

Strategic Structural Decisions

Entity structure plays a crucial role in tax efficiency, for instance, small-business owners often overlook the benefits of electing S-Corp status, leading to potential overpayment of self-employment taxes. Implementing entity-specific strategies can significantly reduce tax liabilities and enhance financial outcomes.

Leveraging Tax Credits and Incentives

Tax credits and incentives offer substantial opportunities for tax savings. Programs such as the Inflation Reduction Act provide credits for clean energy initiatives, including carbon capture and renewable energy investments. These incentives encourage sustainability and innovation while also lowering tax burdens and supporting larger strategic objectives.

Continuous Vigilance and Adaptation

Regularly reviewing and adjusting strategies ensures that businesses can capitalize on new opportunities and mitigate potential risks. This ongoing vigilance is critical for maintaining tax efficiency and achieving long-term financial objectives.

6) Why Apex Advisor Surpasses the Competition

Personalized, proactive strategies are essential today, and we combine advanced technology, continuous oversight, and tailored planning to maximize after-tax outcomes.

Tailored multi-account strategies: We design bespoke plans that reflect each client’s unique asset mix and goals, ensuring every investment choice supports long-term success rather than relying on generic models.

Real-time oversight: Through continuous monitoring and direct indexing across accounts, we make timely adjustments that keep portfolios tax-efficient and performance-optimized.

Year-round optimization: Our approach combines tax-loss harvesting, account coordination, and rebalancing to sustain after-tax advantages well beyond annual reviews.

Integrated retirement planning: HSAs, Roth conversions, and 401(k)s are strategically coordinated with taxable accounts, reducing tax drag while strengthening overall financial plans.

Ongoing vigilance: We actively review structures, regulatory changes, credits, and entity planning, adapting strategies as laws and personal circumstances evolve.

With this comprehensive approach, clients can preserve and grow wealth efficiently while reducing unnecessary tax burdens.

Turn Strategy into Lasting Advantage Today

Tax efficiency is not simply about compliance, it is about building a financial plan that adapts to change and consistently works in your favor. At Apex Advisor, we combine personalized planning, advanced technology, and vigilant oversight to ensure your wealth grows with purpose while minimizing unnecessary tax burdens.

By coordinating accounts, implementing proactive strategies, and anticipating shifts in law and markets, we help transform complex tax challenges into opportunities for long-term advantage. Our goal is simple, to keep more of your hard-earned money working for you.

If you are ready to take control of your financial future, schedule a consultation with Apex Advisor today. Together, we will design a tax-smart strategy that preserves your wealth, aligns with your goals, and delivers year-round confidence.

September 14, 2025

How Proper Accounting Can Simplify Tax Season

The receipts are everywhere, scattered like leaves after a storm, some crumpled at the bottom of drawers, others peeking out of envelopes long forgotten. Your inbox is clogged with tax reminders, each one a quiet nudge of impending deadlines, while the calendar insists it is already March, as if mocking your unpreparedness. The annual ritual begins, a frantic search for numbers, forms, and proof, digging through piles of statements and digital files, double-checking every entry for accuracy.

For many business owners, tax season feels less like a task and more like an endurance test, measured in sleepless nights, endless spreadsheets, and the gnawing worry that one overlooked receipt could trigger penalties or audits. Amid the chaos, the pressure to get everything right weighs heavily, transforming what should be a routine process into a trial of patience, precision, and resolve.

Yet it does not have to be this way. There is a reason some businesses glide through tax season while others struggle and it starts months before April ever arrives.

1) The Year-Round Advantage of Proper Accounting

Proper accounting is not merely an annual obligation; it constitutes a systematic and disciplined practice embedded within the operational framework of a business. It means tracking every dollar with precision, categorizing expenses with consistency, and reconciling accounts before discrepancies turn into headaches.

APEX Advisor builds this foundation with systems that keep records orderly, deductions documented, and errors to a minimum. When done year-round, the advantages are immediate:

A smoother tax season with no last-minute scramble for missing figures.

Proactive tax planning that seizes opportunities before deadlines pass.

Lower stress and more free time to focus on growth instead of paperwork.

Proper preparation is the difference between tuning a well-maintained engine for a long drive and repairing a breakdown on the shoulder, as those who wait until the last moment quickly face mounting costs.

2) The Cost of Waiting Until Tax Season

When accounting is deferred until tax season, the calendar assumes the role of an adversary. Approaching deadlines amplify pressure, and each missing receipt or unverified figure diminishes the time available for prudent and deliberate financial decision-making.

Penalties for late filing can add up quickly, yet the larger loss often comes in deductions that slip through the cracks when work is rushed. Catch-up accounting brings its own price, overtime pay, late-night hours, and the forfeiture of strategic tax moves that could have been set in motion months earlier.

For business owners and finance teams, the process can feel less like problem-solving and more like crisis management. Yet the most frustrating part is knowing that many of these costs are avoidable with the right preparation, and the benefits can be even greater.

3) How Proper Accounting Unlocks Bigger Tax Benefits

With proper accounting maintained throughout the year, tax season transforms from a mere compliance exercise into a strategic opportunity to capture value. Continuous monitoring and systematic recordkeeping enable APEX Advisor to identify tax-saving opportunities while they remain actionable, rather than after deadlines have passed.

This proactive approach ensures businesses maximize benefits, minimize risks, and make informed financial decisions with confidence and precision.The benefits are apparent:

Strategic timing of purchases: Acquiring equipment or other qualifying assets before year-end can trigger accelerated depreciation under current IRS rules, reducing taxable income and freeing up cash for growth.

Capturing every available credit: From energy-efficiency incentives to industry-specific credits, eligibility often hinges on timely documentation that only year-round records can provide.

Early adjustments to strategy: Mid-year insights allow for smarter decisions on income deferral, charitable contributions, or business structure changes.

The outcome is simple: less paid in taxes, more capital to invest back into the business. And with the right technology, this process becomes effortless. Next, we’ll see how technology makes this proactive strategy effortless, not burdensome.

4) Leveraging Technology for Effortless Tax Prep

When technology and human insight come together, tax preparation transforms from chore to craft. Cloud-based accounting platforms give APEX Advisor and its clients a shared window into real-time financial health, eliminating the need to wait for month-end reconciliations or chase missing figures. This immediate visibility allows for timely decision-making and proactive problem-solving.

Automation ferries expense data and invoices into the system, reducing manual entry and freeing teams to focus on strategic initiatives, rather than repetitive tasks. How APEX Advisor blends technology with human expertise for accuracy:

Automated data capture records transactions instantly, minimizing errors and accelerating workflow.

Expert review of records ensures accuracy, proper categorization, and adherence to tax laws.

Real-time monitoring identifies discrepancies before they escalate into costly problems.

Custom reporting is tailored to each client’s unique needs, combining software precision with professional judgment.

For example, a mid-sized services client was able to reconcile hundreds of transactions weekly, catching inconsistencies early and avoiding potential IRS penalties. The result is precision with simplicity, up-to-the-minute accuracy, and a workflow that reduces stress and increases confidence.

Next, we will explore how this approach integrates into the larger APEX method, turning chaos into clarity and setting the stage for long-term financial stability.

5) The APEX Advisor Method: Turning Chaos into Clarity

Every business encounters financial complexity; however, how that complexity is managed can make all the difference. At APEX Advisor, our approach is deliberate, methodical, and designed to transform confusion into clarity, providing businesses with not only compliance but strategic insight that drives growth.

Initial Audit

Our process begins with a comprehensive review of your existing financial records. This initial audit identifies inconsistencies, missing documentation, and overlooked opportunities, ensuring that nothing slips through the cracks. By addressing these gaps early, we lay a foundation of accuracy and transparency that supports every subsequent step.Streamlined Processes

Next, we implement tailored systems designed to streamline your accounting workflows. Income, expenses, and deductions are tracked systematically, reducing errors and improving efficiency. These processes are customized to your business’s size, complexity, and operational model, ensuring that financial data is organized, accessible, and actionable at all times.Regular Check-Ins and Adjustments

Accounting is not static, and neither is our approach. APEX Advisor schedules ongoing reviews to adjust your financial strategy in response to business growth, changing market conditions, or evolving tax laws. Regular monitoring allows us to proactively address potential risks, optimize opportunities, and keep your business on a stable financial trajectory.Seamless Tax Filing Support

When tax season arrives, the preparation conducted throughout the year makes filing straightforward and stress-free. APEX Advisor manages the complex details, ensures accuracy, and identifies all eligible benefits, minimizing liabilities and maximizing compliance.

By following this structured, year-round approach, what often feels like chaos becomes clarity. Businesses gain confidence, reduce risk, and position themselves for sustainable growth. This foundation not only simplifies tax season but also builds financial resilience that carries forward throughout the year and beyond.

6) Beyond Tax Season: Building a Financially Resilient Business

Proper accounting is not merely a tool for tax compliance; it is the backbone of strategic financial management. With accurate and timely financial records, businesses can move beyond reactive measures and engage in proactive planning.

Budgeting and forecasting become more than annual tasks, they transform into dynamic processes that inform daily decisions and long-term strategies.

The advantages are clear:

Informed Decision-Making: Detailed financial insights enable businesses to make data-driven decisions, optimizing resource allocation and identifying growth opportunities.

Enhanced Cash Flow Management: Accurate tracking of income and expenses helps in anticipating cash shortages or surpluses, allowing for timely adjustments.

Risk Mitigation: Regular financial reviews help in identifying potential financial pitfalls early, enabling businesses to implement corrective measures before issues escalate.

Tax season, then, becomes a checkpoint, a moment to assess the financial health of the business and adjust strategies accordingly. It is not the culmination of financial efforts yet a part of an ongoing process of financial stewardship.

APEX Advisor helps clients remain tax-ready year-round by cultivating disciplined practices in consistent record-keeping, periodic financial reviews, and strategic planning.

By embedding these habits into daily operations, businesses are not only prepared to meet tax obligations efficiently, however they are also positioned to seize opportunities for growth, optimize cash flow, and enhance overall financial resilience.

This proactive approach minimizes the risk of errors or penalties, ensures accurate reporting, and allows organizations to make informed decisions with confidence throughout the fiscal year.

7) Stress-Free April is Possible

Tax season no longer needs to be a source of dread or last-minute chaos. With disciplined, year-round accounting, the process becomes clear, manageable, and even empowering. This transformation is not accidental; it is the result of thoughtful systems, expert guidance, and continuous care.

APEX Advisor stands ready to be the partner who guides you through this journey, turning complexity into clarity and uncertainty into confidence. Their personalized approach ensures your business is prepared well before deadlines loom, maximizing savings and minimizing stress.

If you’re ready to reclaim your time and take control of your financial future, reach out to APEX Advisor today. Your stress-free April starts with a single call.

September 3, 2025

How to Use Financial Due Diligence to Avoid Tax Penalties

In March 2025, Maria Lopez, a small business owner in Florida, believed she was fully on top of her finances. She had an accountant, filed her taxes on time, and never imagined the IRS would come knocking. Then came the letter. A review of her recent tax returns uncovered a series of discrepancies, and within weeks, she was facing thousands of dollars in penalties she had no idea she owed.

Stories like hers are more common than most business owners realize. Tax penalties often result from small errors that slip through unnoticed, from misclassified expenses to overlooked income sources. Financial due diligence, the careful review of every line in the books, is one of the few strategies that can catch those mistakes before they become costly. However, how can you make sure your own business doesn’t become the next cautionary tale?

1) What Is Financial Due Diligence?

Financial due diligence is a deliberate and thorough examination of your financial records designed to uncover inconsistencies, potential risks, and opportunities for improvement. Rather than focusing only on tax season deadlines, it digs deeper, reviewing everything from income streams and expense categories to historical tax filings and supporting documents.

This level of scrutiny benefits everyone.

For individuals, it helps ensure that income is properly reported and deductions are fully supported.

For small businesses, it can reveal gaps in accounting practices that might lead to penalties or missed opportunities.

And for larger corporations with complex operations, it serves as an essential safeguard, verifying that every part of the organization is in line with regulatory requirements.

The process also plays a vital role in maintaining compliance with federal, state, and local tax laws. It is not simply about avoiding mistakes, it’s more about the confidence that your financial picture can withstand any level of scrutiny. That confidence can make the difference between a smooth audit and a costly penalty.

Yet understanding what financial due diligence is only the beginning. The real question is why tax penalties are so prevalent, and how even a single oversight can set off a chain of expensive consequences.

2) Why Tax Penalties Are a Real Threat